claim working from home allowance 2020/21

The allowance gives workers 6 a week to cover any working from home costs and can be applied for any time after the new tax year. If you had to work from home during the 202021 tax year and havent claimed for the tax relief yet then it isnt too late.

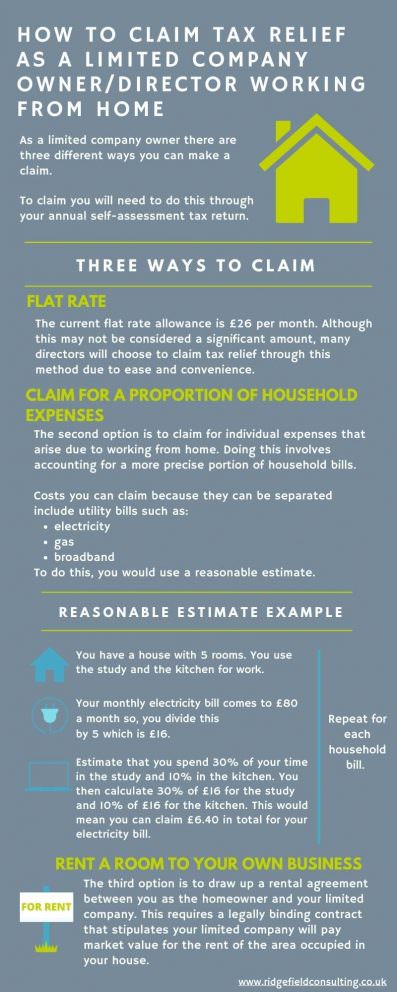

Different Ways To Claim Tax Relief When Working From Home

During Covid restrictions I was unable to work with clients in their homes but we managed to work online with me working from home of course.

. The exemption is a temporary measure covering the period from 16th March 2020 until the end of the tax year 202021. HMRC said that people could claim the working from home allowance for the entire 202021 tax year if they had worked at home for just one day because of the coronavirus restrictions preventing them from attending their place of work HMRC has now confirmed that the same relaxed rule will apply for the 202122 tax year. Employers should note that exemption is dependent on this benefit being made to all employees who need to work from home equally. The allowance is to cover tax-deductible additional costs that employees who are required to work from home have incurred such as heating and lighting the workroom and business telephone calls.

If you do then simply make a claim on your 202021 tax return. If you worked from home during the last tax year but failed to. The percentage of your costs that Revenue counts as working from home expenses You can claim relief on costs at the following rates. For 2022 30 for electricity heating and internet costs For 2020 and 2021 30 for internet costs and 10 for electricity and heating costs For 2018 and 2019 10 for electricity and heating costs only.

Employees can claim a fixed amount of 4 per week up to 5 April 2020 then 6 per week thereafter. To claim for tax relief for working from home employees can apply directly via GOVUK for free here. Covid and working from home tax relief - how to claim. As I complete a self assessment for property I own it states it must be done through this however cannot see anywhere or the form to add this.

A link to the HMRC micro-service portal. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of. The Government made a significant change for 202021 increasing the weekly limit to 6 per week with effect from April 6 2020. You can claim 080 for every hour you worked from home.

Working from home allowance 202021. For example things you bought like a desk. This is to cover all your extra costs of working from home. I understand I can claim 6week due to having had to work from home last year but Ive been all through all the self assessment pages I can find and cant see any box to fill in to claim this.

21 October 2020 at 848AM in Coronavirus Travel Help Info I have been working from home since 5 March and cannot find how to claim the allowance on my tax return. It also stated that an individual only has to work from home for one day to claim the whole years allowance. However lets say that your employer re-opens their offices from Monday 3 August 2020 and asks you to start going back in. In practice most employees will have been mandated to work from home as a result of Government guidance at some point during 2020-21.

This seems to fit the bill for the 6 allowance available but for the life of me I cant find the route on the Self Assessment form and the advice I find all seems to relate to those employed but who have had to work at home. To claim for tax relief for working from home employees can apply directly via GOVUK for free. How much you can claim You can either claim tax relief on. At the time you stop working from home you.

The way you claim the working from home allowance will depend upon if you submit a self-assessment tax return. Once their application has been approved the online portal will adjust their tax code for the 2021. Once their application has been approved the online portal will adjust their tax code for the. Employees who complete a self- assessment return should make a claim for 202021 when completing the tax return.

Employees can claim the working from home allowance for tax year 2021-22 08 April 2021 Those employees who incur extra household costs due to working from home regularly for either part or all of the week can claim the working from home allowance for. For those employees who qualify to claim for tax year 202021 but did not make a claim they are able to make a claim using the online facility. The claim will result in a tax refund for 202021 of 6240 6 x 52 weeks 312 x 20. HMRC have advised that as long as an employee has been required to work from home at some point during 2020-21 they will accept a claim for home-working for the whole 2020-21 tax year.

The temporary shortcut method initially applied from 1 March to 30 June 2020 however it can now be applied up until 30 June 2022. Workers who had to work from home during the pandemic can now claim the working from home allowance for the 202122 tax year. Assuming you were working from home at 6 April the start of the tax year you would only be entitled to tax relief for 17 weeks of the tax year that is on 6 x 17 102. Whichever method you choose youll need to claim your use of home as office allowance in the self-employment section of your tax return.

If your business turnover is less than 85000 for 20212022 youll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. The shortcut method is just one of three ways available to work out your deduction for working from home expenses. You cannot claim for anything else. In October 2020 the Government created a new temporary working-from-home microservice to help claim the tax relief for the 202021 tax year.

It meant you could claim once and get it automatically for ALL of the tax year at the 6week relief rate. Tax allowances for home workers are not new but in October 2020 the Government created a new temporary working-from-home microservice to help claim the tax relief for the 202021 tax year. Everyone else needs to make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on 1 October 2020. I know theres an online portal specific to this claim but its only appropriate for this.

Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. 1 July 2020 to 30 June 2021 the 202021 financial year 1 July 2021 to 30 June 2022 the 202122 financial year. When we first spotted this I couldnt quite believe it so I pushed HMRC hard to check it was true. Around three million people made a claim for the entire 2020-21 tax year.

Claims For Working From Home Tax Relief On The Rise Tax Rebate Services

How To Claim The Working From Home Tax Relief Times Money Mentor

Pin By Gowthaman On Gspy Post Work Experience Textbook Text

Different Ways To Claim Tax Relief When Working From Home

7th Cpc Training Allowance Pcda O Message No 01 2021 Regarding Clarification On Admissibility Of Training Allowance Messages Train Allowance

Posting Komentar untuk "claim working from home allowance 2020/21"